How I Nailed My Retirement Community Move With a Smarter Asset Split

Moving into a retirement community isn’t just about packing boxes—it’s about protecting your money for the long haul. I learned this the hard way, nearly misallocating my savings in the excitement of a fresh start. What seemed like a solid plan fell apart under hidden costs and emotional decisions. But after adjusting my asset strategy, I found balance. This is how I structured my portfolio to keep growing wealth while staying safe—and how you can too, without the stress.

The Reality Check: Why Retirement Communities Demand Financial Prep

Retirement communities offer comfort, companionship, and convenience, but they come with a financial footprint that many retirees underestimate. Unlike traditional downsizing, which often reduces housing costs, moving into a senior living facility can involve substantial upfront and recurring expenses. Entry fees, which may range from tens of thousands to over a hundred thousand dollars depending on the region and level of care, are just the beginning. These fees are sometimes partially refundable, but rarely in full, and the terms vary widely between communities. On top of that, monthly service charges—covering meals, maintenance, housekeeping, and social activities—can exceed $4,000 in higher-tier facilities. These figures alone require careful budgeting, but the real challenge lies in anticipating what comes next.

Beyond predictable costs, retirees must account for healthcare contingencies. Many communities offer tiered care models, where residents pay more as their needs increase—from independent living to assisted care to memory support. A move that starts with modest monthly fees can evolve into a significantly higher financial commitment within just a few years. Without a strategy that accounts for these potential escalations, retirees risk draining their liquid savings too quickly. This is especially true for those who rely heavily on fixed income sources like pensions or Social Security, which may not keep pace with rising living costs.

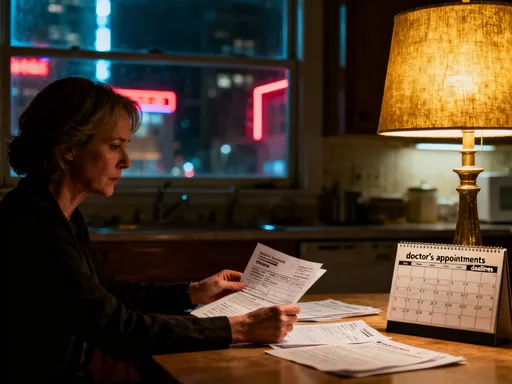

The emotional appeal of a retirement community can cloud financial judgment. The inviting tours, the friendly staff, and the promise of a worry-free lifestyle often lead people to overlook long-term implications. Some sign contracts without fully understanding the fee structure or the conditions under which costs might increase. Others assume their current assets will stretch further because they’re leaving behind a mortgage or property taxes. While those savings are real, they can be offset by new expenses. The key is to treat the move not as a financial simplification, but as a transition requiring deliberate planning. That means reviewing all income sources, projecting future needs, and stress-testing your budget against different scenarios before making a decision.

Proper preparation also involves understanding how your new living arrangement affects your tax situation and estate planning. Some communities are structured as life lease or entrance fee models, which can have implications for Medicaid eligibility or inheritance. Consulting with a financial advisor familiar with senior housing options can help clarify these nuances. The goal is not to avoid the move, but to enter it with eyes wide open. When you align your financial strategy with the realities of retirement living, you protect not just your savings, but your peace of mind.

Asset Allocation Isn’t Just for Wall Street: Why It Matters Where You Live

Many people think of asset allocation as a topic reserved for stockbrokers and investment firms, something abstract and distant from daily life. But in retirement, especially when living in a community designed for long-term care, how you divide your money becomes a direct determinant of lifestyle and security. It’s not just about returns on paper—it’s about whether you can cover your monthly fees, handle an unexpected medical bill, or still afford to travel and enjoy time with family. A well-structured portfolio acts like the foundation of a home: invisible but essential. Without it, even the most comfortable setting can feel unstable.

At its core, asset allocation is about balancing three goals: preserving capital, generating income, and maintaining growth potential. Cash and short-term instruments like savings accounts or money market funds offer safety and immediate access, making them ideal for covering near-term expenses. Bonds, including government and high-quality corporate issues, provide steady income with relatively low volatility. Together, these form the stability layer of a retiree’s financial plan. But relying too heavily on them carries a hidden cost: inflation risk. Over time, the purchasing power of fixed-income returns erodes, meaning that even if your account balance stays the same, what it can buy diminishes. For someone paying rising monthly fees in a retirement community, this slow decline can be especially damaging.

On the other side of the spectrum, equities—stocks and stock-based funds—offer growth potential that can outpace inflation and help your portfolio last longer. Historically, the stock market has delivered average annual returns of around 7% to 10% over the long term, even after accounting for downturns. For retirees with a time horizon of 15 to 20 years or more, excluding equities entirely means missing out on a powerful tool for wealth preservation. Yet many retirees shy away from stocks out of fear, especially after experiencing market drops in their working years. The result is portfolios tilted too far toward safety, which may feel emotionally reassuring but can lead to financial strain down the road.

Real estate, including a former primary home or rental properties, is another key asset class that requires thoughtful integration. While owning property can provide value, it also introduces illiquidity and management responsibilities. For retirees moving into a community, selling a home may generate a significant influx of cash, but how that money is reinvested determines its long-term impact. Simply parking it in a low-yield account may seem cautious, but it fails to protect against inflation. The smarter approach is to view each asset class as serving a purpose: cash for immediate needs, bonds for predictable income, equities for growth, and real estate as a strategic component that can be timed for optimal benefit. When these pieces work together, they create a financial ecosystem that supports both stability and sustainability.

My Mistake: Putting Too Much in "Safe" Accounts—And Paying the Price

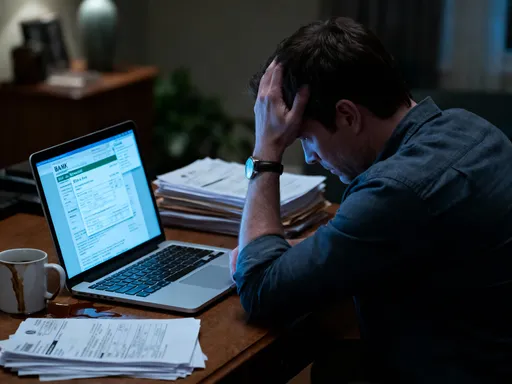

When I moved into my retirement community, I believed I was being prudent. I sold my home, paid off debts, and placed the majority of my remaining savings into high-yield savings accounts and short-term certificates of deposit. These were labeled “safe,” and in the moment, that was all I wanted. I told myself I didn’t need growth—I needed security. I wanted to sleep soundly knowing my money was protected from market swings. What I didn’t realize was that I was trading one kind of risk for another. Within a few years, the quiet but relentless force of inflation began to take its toll. The purchasing power of my savings slowly declined, and I found myself adjusting my budget more frequently than I had anticipated.

The real wake-up call came when I faced an unexpected health issue that required outpatient surgery and follow-up care. My insurance covered part of the cost, but I was still responsible for several thousand dollars in co-pays and related expenses. Because most of my money was in low-liquidity or low-return accounts, I didn’t have enough accessible cash to cover the bill without making changes. I had to sell some of my stock holdings—investments I had planned to keep long-term—but I did so at a time when the market was down. That meant realizing a loss, which further weakened my financial position. I had tried to avoid risk, but by misjudging the nature of risk itself, I ended up in a worse position than if I had maintained a more balanced portfolio.

This experience taught me that “safe” doesn’t always mean “secure.” In fact, excessive caution can be a form of financial vulnerability. When returns don’t keep up with inflation, you’re effectively losing money in real terms. A dollar saved in a 1% interest account while inflation runs at 3% is worth less each year. For retirees on a fixed budget, this erosion can force difficult choices—skipping social events, delaying necessary home repairs in the community, or even cutting back on healthcare. The emotional comfort of knowing your principal is intact can be misleading if the actual value of that principal is shrinking.

What I now understand is that risk management in retirement isn’t about eliminating all volatility—it’s about managing different types of risk in a way that aligns with your goals and timeline. Market fluctuations are uncomfortable, but they are temporary. Inflation and longevity—the risk of outliving your money—are permanent threats that require active mitigation. A truly conservative strategy isn’t one that avoids stocks entirely; it’s one that includes enough growth-oriented assets to preserve purchasing power over time. My mistake was letting fear override logic. The correction wasn’t dramatic—I didn’t shift everything into equities—but I did rebalance to include a meaningful allocation to diversified, low-cost index funds. That small change has made a significant difference in how my portfolio performs and how confident I feel about the future.

Building a Resilient Portfolio: The 3-Zone Strategy That Keeps Me Covered

After my financial misstep, I worked with a fee-only financial advisor to rebuild my portfolio using a framework that made sense for my lifestyle and goals. We developed what I now call the 3-Zone Strategy—a simple but effective way to organize assets based on purpose rather than performance alone. The three zones—Safety, Income, and Growth—each serve a distinct role in supporting long-term stability. This approach doesn’t rely on rigid percentages; instead, it’s flexible, allowing adjustments based on health, family history, and changes in community fees. The result is a portfolio that feels secure without sacrificing long-term resilience.

The Safety Zone is designed to cover essential living expenses for at least two to three years. This includes monthly community fees, utilities, insurance premiums, and other predictable costs. Funds in this zone are kept in highly liquid, low-volatility accounts such as savings accounts, money market funds, and short-term Treasury securities. The goal is immediate access and principal protection. Because this money must be available when needed, it’s not exposed to market risk. For me, this zone makes up about 25% of my total portfolio, though the exact percentage depends on individual circumstances. Someone with a stable pension might need less in safety reserves, while someone with variable healthcare needs may require more.

The Income Zone focuses on generating reliable cash flow to replenish the Safety Zone over time. This typically includes high-quality bonds, dividend-paying stocks, and fixed-income funds. These assets are selected for their consistency rather than high returns. They are not meant to deliver rapid growth, but to provide a steady stream of income that can be withdrawn systematically. I structured this zone to produce enough annual yield to cover my anticipated withdrawals beyond what’s in the Safety Zone. By staggering bond maturities and including a mix of government and corporate issues, I’ve reduced interest rate risk while maintaining dependable returns. This zone accounts for roughly 40% of my portfolio and serves as the bridge between immediate needs and long-term growth.

The Growth Zone is where I maintain exposure to equities, primarily through low-cost, diversified index funds and ETFs. This portion of the portfolio is not for spending in the short term; it’s meant to grow over decades, counteracting inflation and preserving wealth for later years. I allocate about 35% here, a percentage that feels comfortable given my health and family longevity. The key insight is that even in retirement, time is on your side if you plan for a 20- or 30-year horizon. Market downturns still happen, but I’ve learned to view them as temporary, not catastrophic. By keeping this zone invested and rebalancing annually, I ensure that gains are captured and risk is managed without emotional interference. The 3-Zone Strategy doesn’t eliminate uncertainty, but it transforms it into a structured, predictable process.

Avoiding the Liquidity Trap: When You Have Money—but Can’t Use It

One of the most common financial pitfalls in retirement is being “asset-rich but cash-poor.” This occurs when a person owns significant value—often in real estate, retirement accounts, or long-term investments—but lacks immediate access to funds when they’re needed. In the context of a retirement community, this mismatch can be particularly stressful. You might own a $500,000 home or have a $400,000 IRA, but if that money is locked in an illiquid form, it won’t help when the community increases its fees or a medical emergency arises. Liquidity—the ability to convert assets into usable cash without penalty or loss—is just as important as the total value of your portfolio.

The liquidity trap often results from poor timing or overemphasis on long-term gains. For example, some retirees invest heavily in long-term certificates of deposit (CDs) because they offer slightly higher interest rates. But if those CDs have five-year terms, the money is effectively frozen. Withdrawing early triggers penalties that erase any benefit from the higher rate. Similarly, relying too much on retirement accounts like traditional IRAs or 401(k)s can create challenges, especially before age 59½, when early withdrawals incur taxes and penalties. Even after that age, required minimum distributions (RMDs) can force withdrawals at inopportune times, potentially pushing you into a higher tax bracket or selling assets at a market low.

To avoid this trap, I now use a laddered approach to fixed-income investments. Instead of putting all my bond funds into one long-term instrument, I spread them across multiple maturities—say, one-year, three-year, and five-year Treasuries. As each matures, the funds are either reinvested or moved into the Safety Zone. This creates a rolling source of accessible capital that aligns with my spending needs. I also keep a portion of my emergency reserve in a high-yield savings account, which offers both liquidity and modest growth. Additionally, I’ve coordinated my withdrawal strategy across taxable, tax-deferred, and tax-free accounts to maintain flexibility and tax efficiency. By planning for when and how I access my money, I’ve reduced the risk of being caught short when life throws a curveball.

Liquidity isn’t just about having cash—it’s about having the right amount of cash at the right time. It’s also about understanding the rules and penalties associated with different account types. For retirees in a community setting, where monthly obligations are predictable but healthcare costs are not, this foresight is essential. The goal is not to keep all your money in cash, which would erode value over time, but to ensure that a sufficient portion is readily available without triggering losses or tax consequences. With this approach, I’ve gained confidence that I can meet both expected and unexpected expenses without derailing my long-term financial plan.

Working With Advisors—And Knowing When to Push Back

Not all financial advice is created equal, and not every recommendation is right for every retiree. I’ve learned that working with a financial advisor shouldn’t mean handing over control. The best relationships are collaborative, where the advisor provides expertise and the client brings personal goals and values. In my experience, some advisors default to generic solutions—like allocating 60% to bonds simply because “that’s what retirees do”—without considering individual circumstances. Others promote products with high fees or commissions, such as annuities or proprietary mutual funds, that may not be the most cost-effective choice. Recognizing these patterns has helped me become a more informed and assertive participant in my financial planning.

One red flag I’ve learned to watch for is overemphasis on complex products. If an advisor spends more time explaining how a product works than how it fits into my overall strategy, that’s a warning sign. Simplicity is often a strength in retirement planning. Low-cost index funds, for example, have consistently outperformed actively managed funds over time, yet some advisors still push the latter because they generate higher fees. I now ask specific questions: What are the total annual expenses of this fund? How does it compare to a broad market index? Is there a commission involved? These questions help me cut through the noise and focus on what truly matters—performance, cost, and alignment with my goals.

I also pay close attention to risk assessments. Many firms use standardized questionnaires to determine a client’s risk tolerance, but these can be misleading. A retiree might score as “conservative” because they dislike market volatility, but if they have a long life expectancy and rising living costs, a truly conservative portfolio could be the riskiest choice of all. I’ve learned to push back when recommendations don’t account for inflation or longevity. Instead of accepting a one-size-fits-all approach, I advocate for a personalized plan that balances emotional comfort with financial reality. This doesn’t mean disregarding an advisor’s expertise—it means engaging with it critically and thoughtfully.

Another important aspect is fee transparency. I now work with a fee-only advisor who charges a flat annual rate based on assets under management, rather than earning commissions from product sales. This alignment of incentives gives me greater confidence that the advice I receive is in my best interest. I also review my portfolio annually, not to make constant changes, but to ensure it still reflects my goals and market conditions. The relationship has become one of mutual respect—where I listen, question, and decide, and the advisor supports rather than directs. This level of engagement has made me feel more in control of my financial future, even as I enjoy the comforts of community living.

Long-Term Thinking in a Short-Term World: Staying the Course Without Stress

Retirement is a marathon, not a sprint, yet the financial world often speaks in headlines and quarterly results. Market downturns, economic forecasts, and sensational news stories can create anxiety, especially for retirees who depend on their portfolios for income. The temptation to react—to sell stocks after a drop or shift everything into cash at the first sign of trouble—is strong. But history shows that the biggest threat to long-term financial success isn’t market volatility; it’s behavioral mistakes. Staying the course, even when it feels uncomfortable, is one of the most powerful strategies a retiree can adopt.

My 3-Zone Strategy helps insulate me from emotional decision-making. Because I have a dedicated Safety Zone, I don’t need to sell investments during a downturn to cover monthly expenses. This removes the pressure to act impulsively. I also avoid checking my account balances daily, which only amplifies stress. Instead, I review my portfolio once a year, or after a major life event like a health change or a shift in community fees. These deliberate, infrequent reviews allow me to make thoughtful adjustments without overreacting to short-term noise. If the market has performed well, I may rebalance by selling some equities and adding to bonds. If it has declined, I leave growth assets untouched, knowing they have time to recover.

Peer influence can also test discipline. It’s easy to feel anxious when a friend brags about doubling their money in a speculative stock or when someone warns that “the market is about to crash.” But retirement planning isn’t about chasing gains or avoiding every dip—it’s about consistency, balance, and sustainability. My focus is not on getting rich, but on staying secure. That means accepting moderate returns in exchange for reduced risk and greater peace of mind. In my retirement community, where social connections matter, I’ve learned to discuss finances with curiosity rather than comparison. Sharing strategies and lessons is valuable, but copying someone else’s portfolio rarely leads to better outcomes.

Ultimately, smart asset allocation isn’t about complexity or market timing. It’s about designing a financial life that supports your personal well-being. For me, that means sleeping soundly, enjoying meals with friends, and knowing I can handle whatever comes next. The numbers matter, but so does the sense of calm that comes from being prepared. By aligning my portfolio with my lifestyle, my timeline, and my values, I’ve turned what could have been a source of stress into a foundation of confidence. And that, more than any return percentage, is the true measure of financial success in retirement.